In "The Universal Tax Code," Don Jayamaha Jr. and Tristan Laurens Bernard present a radical vision for taxation, leveraging the power of Central Bank Digital Currencies (CBDCs) and blockchain. This groundbreaking work proposes a universal, transaction-based tax system, inspired by Bitcoin's automated fees, eliminating the need for complex filings and audits. By integrating a real-time deduction system within CBDCs, the authors envision a fairer, more efficient, and transparent method of funding government services. The book explores how this innovative approach can streamline tax collection, close loopholes, capture revenue from the shadow economy, and adapt dynamically to economic shifts. A compelling read for policymakers, economists, and anyone seeking a simpler, more equitable future of taxation.

Review The Universal Tax Code

Honestly, "The Universal Tax Code" blew me away. I went in expecting a dry, technical read about CBDCs and taxation, something potentially interesting but also likely to be a bit of a slog. I was so wrong. The authors, Don Jayamaha Jr. and Tristan Laurens Bernard, manage to present a complex topic with remarkable clarity and enthusiasm. It's not just about the what of a CBDC-based tax system; it's also about the why – a compelling argument for a fairer, more efficient, and frankly, less stressful way to fund our governments.

The book starts by clearly explaining the current failings of our tax systems. We're all familiar with the frustrations: the complexity, the loopholes, the endless paperwork, the feeling that the system is rigged against the average person. Jayamaha Jr. and Bernard don't shy away from these issues; they use them as a springboard to launch into their vision. That vision, a universal transaction tax powered by CBDCs, is initially startling, but the authors meticulously build their case, breaking down the mechanics in a way that's surprisingly accessible even to someone like me, who isn't an expert in either economics or blockchain technology.

What really impressed me was the authors' ability to balance optimism and pragmatism. They don't paint a utopian picture where all problems vanish overnight; they acknowledge the challenges of implementing such a radical change. They address potential concerns, like privacy implications and the need for robust cybersecurity measures, head-on, demonstrating a thoughtful and responsible approach. This isn't some pie-in-the-sky fantasy; it's a well-researched and carefully considered proposal for real-world reform.

The book's strength lies in its ability to inspire. It’s not just about fixing a broken system; it’s about envisioning a better future. Imagine a world without tax season, a world where everyone contributes their fair share automatically, a world where government resources are allocated more efficiently. This isn't just a technological advancement; it's a potential societal shift toward greater fairness and equity. The authors effectively convey this potential, igniting a sense of hope and possibility.

While the book delves into the technical aspects of CBDCs and blockchain, it never loses sight of the human element. It's about people – the taxpayers burdened by an inefficient system, the policymakers seeking solutions, the businesses struggling with compliance. The authors successfully bridge the gap between technical innovation and its impact on everyday lives, making the argument both intellectually compelling and emotionally resonant.

Overall, "The Universal Tax Code" is a must-read for anyone interested in the future of finance, governance, and technology. It's informative, insightful, and incredibly inspiring. It left me feeling not only informed but also hopeful about the potential for positive change in a system that often feels hopelessly broken. I highly recommend it.

Information

- Dimensions: 6 x 0.17 x 9 inches

- Language: English

- Print length: 73

- Publication date: 2024

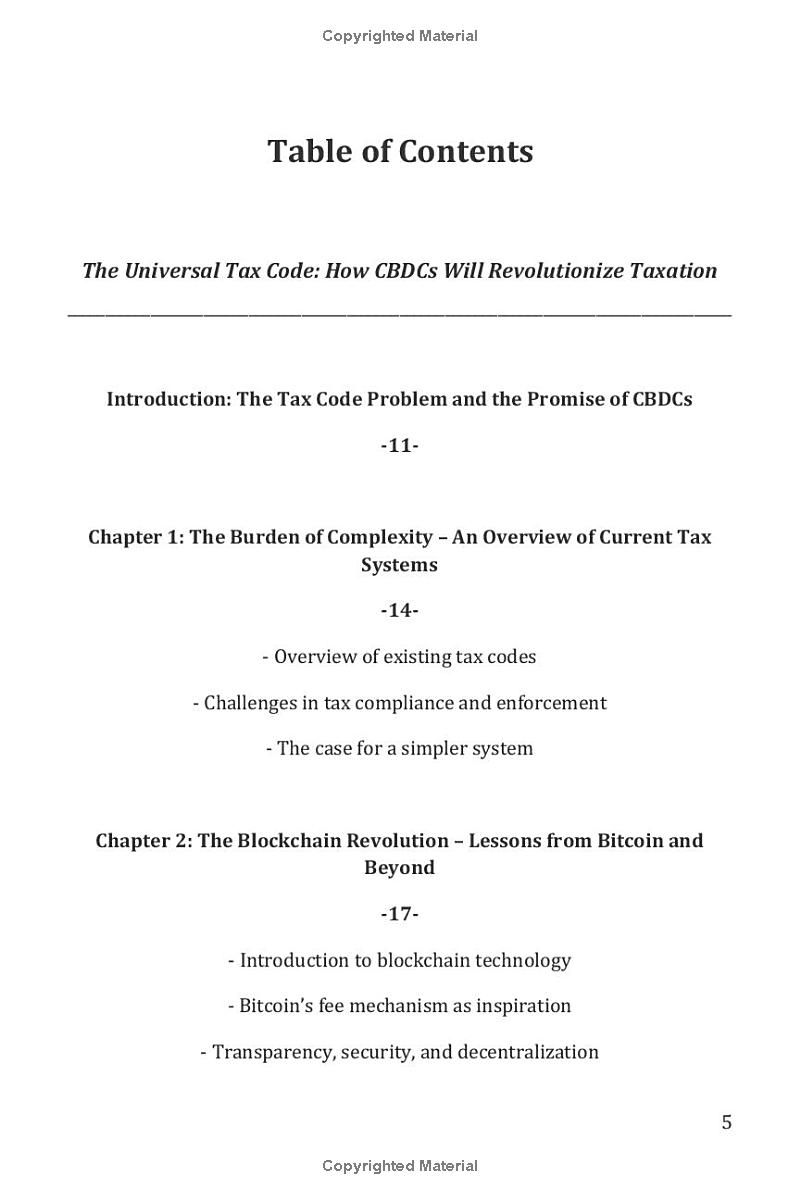

Book table of contents

- Chapter 6: A Fairer System for All - Addressing Income Inequality

- Chapter 7: Tackling the Shadow Economy

- Chapter 8: Dynamic Taxation

- Chapter 9: Government Efficiency

- Chapter 10: Testing and Implementing the Universal Tax Code

- Chapter 11: The Impact on Monetary Policy

Preview Book